I want to share a story with you today about the importance of Product Liability and Completed Operations Coverage. The reason I am sharing in this way is so that you really can relate to it and understand. You don’t need me to throw a whole bunch of large insurance terms into an article, you need to know how this could affect you from a real life type of scenario.

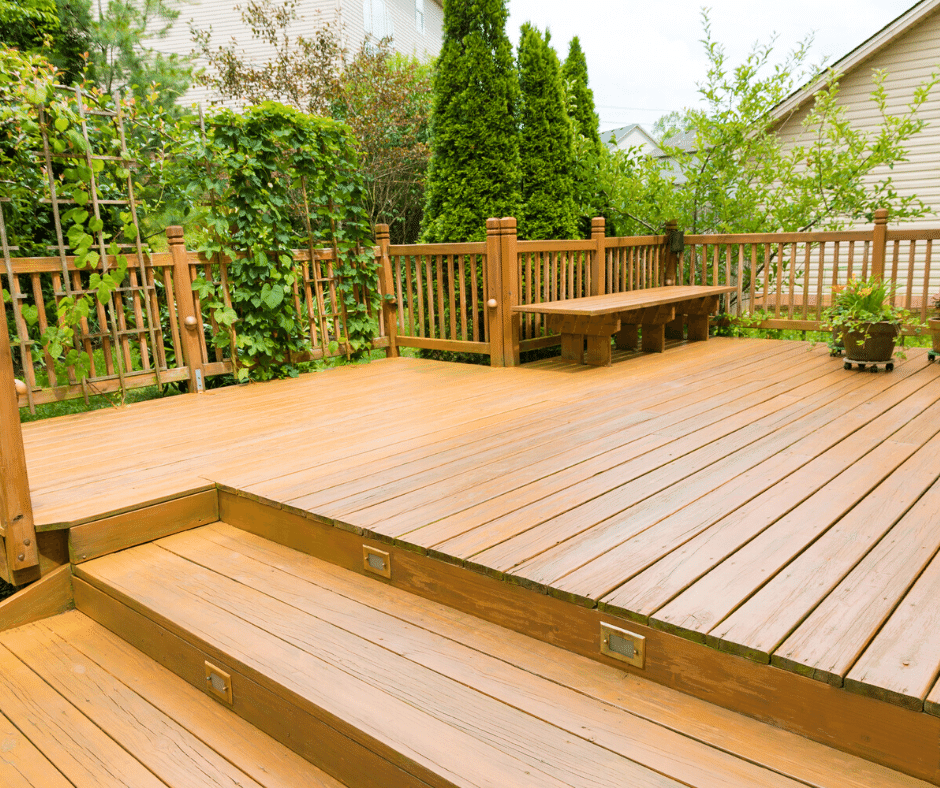

Beautiful Decks by Doug has been installing high-quality residential decks for the past 10 years. Doug is a sole proprietor with no employees and has done all the work himself. For the past decade, he has purchased through his insurance agent an occurrence-based ISO CGL policy with no unusual endorsements. The policy has been in force continuously for the past 10 years.

Doug’s CGL policy always included coverage for the products-completed operations hazard.

Doug is now getting older and since he is financially secure, he has decided that it is time to retire. He sends his policy back to his insurance agent for cancellation on July 1 and the policy is terminated on that date as Dave has requested.

The Incident…

Unfortunately, Maggie, one of Doug’s customers, is seriously injured when the deck she is standing on collapses on August 31. It is later found that in May, when Doug built the deck, he forgot to properly fasten it to the wall. The collapse is the direct result of his failure to fasten the deck to the wall. Maggie’s injuries are found to have been caused by the deck’s collapse.

Maggie moves forward with suing Doug for her injuries. Doug submits the complaint to his insurer. Doug has always purchased coverage for the products-completed operations hazard!

Nevertheless, the harsh reality is that Doug’s CGL insurer has no obligation to defend or respond in any way to the suit—Doug has no insurance for this claim.

CGL Coverage Trigger

The CGL insuring agreement promises to pay only if bodily or property damage occurs during the policy period. While Doug did purchase products-completed operations coverage as part of his CGL policy, the injury to Maggie occurred about 2 months after his policy was terminated. Products-completed operations coverage of the CGL is subject to and does not override this trigger requirement—even if the bodily injury or property damage does arise from the named insured’s product or completed operation.

Products-completed operations coverage does not extend the policy period—the policy must be in effect when the bodily injury or property damage occurs.

Important Considerations

Now that you understand the workings of products-completed operations coverage, it is important to consider several other situations in which a better understanding of exactly what is included in the “products-completed operations hazard” (which is a defined term in the CGL policy) is necessary.

Policy Limits

One of the six CGL limits is the products-completed operations aggregate limit. Knowing the types of claims that fall within and, therefore, reduce or exhaust this aggregate limit is critical.

Only Products-Completed Operations Coverage Is Provided

For liability policies that are written specifically for a construction project, such as a consolidated insurance program (CIP) or “wrap-up,” it is common to provide full CGL coverage for the period of the construction and then to provide products-completed operations only coverage for some period after construction is complete.

For example, in an owner controlled insurance plan (OCIP) the full CGL policy may be provided for a period of 24 months—the anticipated life of the construction.

The coverage provided for products and completed operations in the standard CGL policy seems to get short shrift. Too little attention is paid to the basics of how the coverage works within the context of the entire policy, including the requirement that any bodily injury or property damage, even if caused by an insured’s product or completed work, must take place during the policy period for coverage to apply.

It is only after this deceptively simple concept is properly understood can the more specific issues that surround the “products-completed operations hazard” be appreciated—such as how policy exclusions and other coverage endorsements affect the products-completed operations hazard.

If you have questions about your liability policies please don’t hesitate to reach out to one of our licensed agents at Contractors Insurance Agency. We are happy to help explain everything clearly so you fully understand your coverage.