While most business owners know that they need to have workers compensation insurance, they don’t give much thought to it. However, there are things to avoid if you want to save on Workers Comp Insurance costs.

Here are some of the mistakes to avoid.

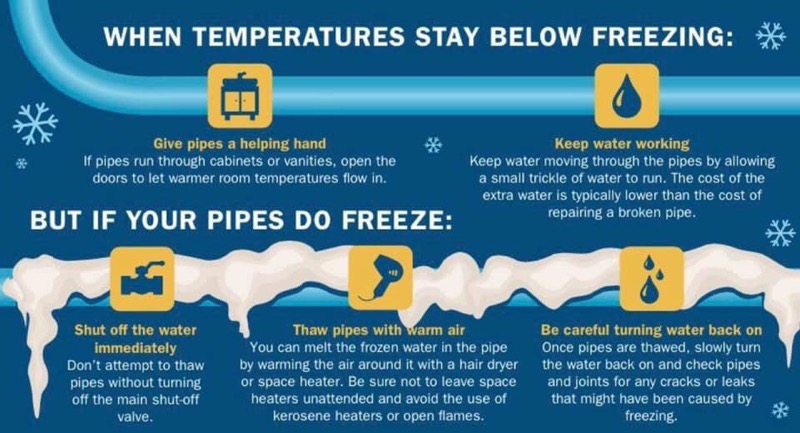

Not Requiring Safety Training for Your Employees

Even if you feel like your business is part of a low-risk industry, it’s important to remember that the risk of employee injury is ever-constant. It’s vital to offer your employees workplace health and safety training. Your training program should educate your staff about the risks they face, how to mitigate these risks, and what to do if an accident occurs. When your employees understand risk factors associated with your business, they are less likely to sustain injuries on the job. This, in turn, will reduce your workers compensation insurance costs.

Not Reporting Claims

When business owners fail to report employee accidents or injuries to their insurers, they are making a costly mistake. While you might think that paying for an employee’s medical treatment out-of-pocket is cheaper than the official claims process, you are leaving yourself open to a considerable amount of risk. If your employee’s injuries end up being more extensive than you thought or if they decide to sue your company, you can no longer access your workers compensation coverage at this point. This means that you will be completely responsible for all of these expenses. Rather than leaving yourself and your business’s assets vulnerable to these possibilities, it’s far better to secure coverage through official channels.

These are some of the workers compensation insurance mistakes that could end up costing you. Do you need further advice or assistance with your business’s insurance? Don’t hesitate to contact the experts at Contractors Insurance Agency. Our dedicated team is ready to help you today.